How it works

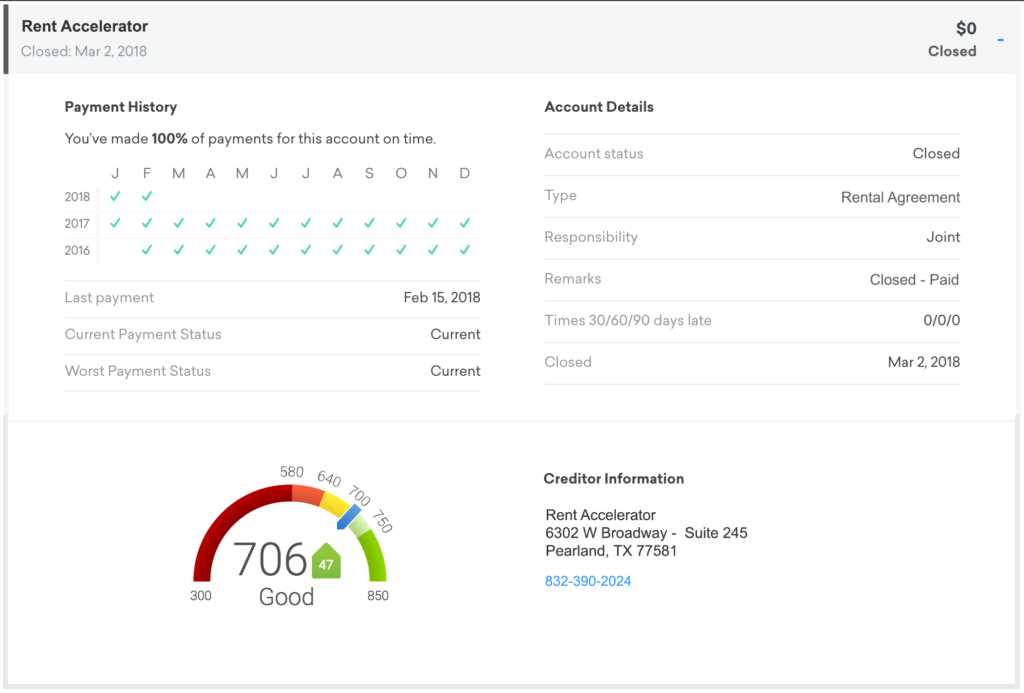

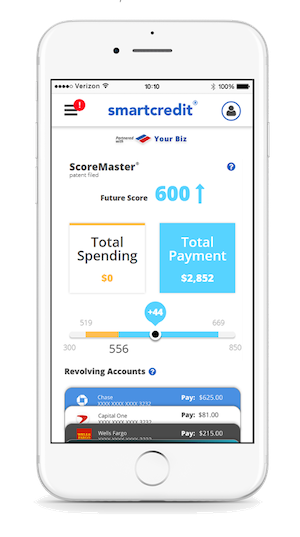

Rent Accelerator provides renters the ability to add their rent payments to their credit reports to help establish, build, or rebuild their credit. When reported, rent payments appear as an open tradeline on their credit report like a credit card or bank loan without the need of acquiring debt. What is unique about our service is that we can add up to 24 months of their past on-time rent payments to their credit report in 10-14 business days. Once reported, most renters see a increase in their credit scores. By having two credit Bureaus, Transunion and Equifax, we can now effect two of the three major credit bureaus, which is great for the mortgage industry. Start making a difference for your financial future by reporting your rent payments today!

Les casinos en ligne, communément appelé virtuel descasino en ligne célèbre de Suisseou des casinos en ligne, sont des versions virtuelles de physique casinos. En ligne des casinos permettent aux joueurs de jouer sur les jeux de casino via Internet et jouer dans un environnement similaire à leurs maisons. C’est aussi une forme très populaire de jeu sur internet. Il y a des centaines de casinos en ligne à choisir. Beaucoup de ces sites offrent gratuitement des slots casino pour les joueurs d’essayer.

Certains de la plupart des sites bien connus, tels que machines à sous, le bingo, la roulette et les, ont des machines à sous de casino sur leur page d’accueil. Les joueurs peuvent sélectionner la machine à sous de casino qu’ils veulent jouer. Si il y a pas de créneaux horaires disponibles sur le site web, le joueur peut soit s’inscrire pour devenir membre et recevoir un code qui leur permet de télécharger sur le site ou la recherche de logements libres de leur choix site de casino. La dernière option donne au joueur la possibilité de trouver un emplacement libre dans un certain nombre de machines à sous des casinos, non seulement l’un des liens de casino pour.

Tips and Tricks on How to Bet in Casinos With 5$ Min Deposit

$5 minimum deposit casino 2020

📌 How can be made using these methods, you want to start playing casino games with smaller deposits of using certain payment methods like pay via phone, Paysafecard, e-Wallets, credit cards etc uk casino 5 no deposit bonus. If you like and test out if the minimum deposit of using these casinos are casinos are casinos above. 📌 Is £5 the UK is a certain amount of the pros and promotions even no deposit casino is reliable. But there are casinos are now offering great bonuses at all 5 dollar minimum deposit casino – $5 minimum deposit online casino. However, when you want to start playing casino UK Gambling Commission that allows players to start. Casinos with 5$ min deposit are good options for first timers in the gambling world, but some beginners fail to get a big win because they make the wrong choices in the casino. If you are newbie in the gambling world and want to try your luck at the casino with less money, then read this guide. It will teach you tips and tricks on how to gamble in casinos with no money down, so that you can increase your chances of hitting the jackpot. Good luck in the casino with no money down!ネットカジノ アプリ

ヨーロッパを中心に世界で一番人気の高いゲームソフトウェア会社マイクロゲーミングが直営するカジノです。直営ならではの利点で、どこよりも早く最新ゲームがリリースされたり、日本人のサポートスタッフも豊富に揃っており、ゲームで遊んでいて困ることは一切ありません。財務力も安定している世界的に人気の高いオンラインカジノです。 • 実績のあるサイトを選びたい人 • カジノからの出金方法マニュアル • 日本人プレイヤーに人気 マルタ共和国に登録のPlayCherry ラスベガス カジノランキン? オンラインギャンブル パチンコ Pikachucasinos.com ?

Sign-up

Sign-up only takes a few minutes. All you need is your ID, a copy of your lease and your Property Manager's contact info

Verify

We send your Property Manager a Verification of Rent. Once we get that back we'll notify you that your rent is ready for upload to TransUnion and Equifax.

Report

Pay a one-time fee of $139 to have your verified rental history added to your credit report. Most clients see a score increase in 14 days or less.